What is Reimbursable?

Date: April 28, 2025 2:03 PM

Table of Contents

Overview: What is Reimbursable

Reimbursable travel expenses can include:

- Local rail (NJ Transit) tickets

- Lodging

- Per Diem for Meals (excluding alcohol)

- Rental vehicles, ground transportation (e.g., car service, taxis, shuttles, and van service)

- Tolls and automobile mileage reimbursement for personal vehicles

- Parking - search Find Products and Services and search keyword “parking” to find an airport parking supplier

- Mileage Reimbursement for driving rental cars or university-owned vehicles

- Baggage expenses

- Hotels / Accommodation

- Anything that can be reasonably attributed to ‘supporting business / research interests at Rutgers’

Non-Reimbursable Expenses:

- Flights

- Flights are paid directly by Rutgers, so they don’t have to be reimbursed

- Airfare must be booked through Rutgers Online Travel Booking Tool (SAP Concur, found in myRutgers Portal) or through the travel agency Direct Travel.

- Flights booked with frequent flyer miles

- Travel insurance

- Gasoline for a personal vehicle is not reimbursable; mileage reimbursement rate covers this cost.

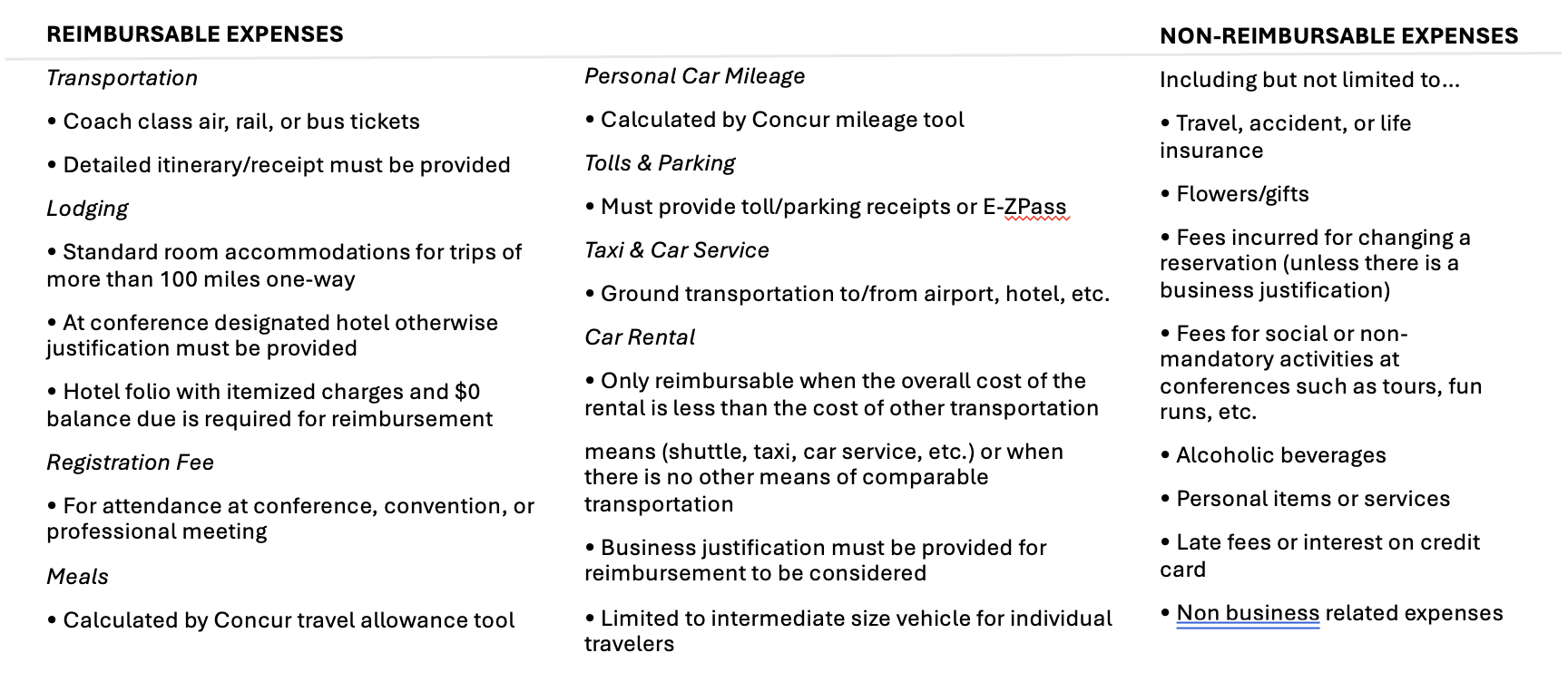

Reference: Reimbursable & Non-Reimbursable Expenses

What Needs to be on Documentation?

The Five “Ws” (Why, Who, What, When and Where) should be entered in the business purpose field for each expense report. A clear business purpose description should contain all information necessary to substantiate the expenditure including a list of attendees and the purpose for attending, business topics, and the benefit to the University. Documentation and back-up for all expenses must be included in the expense report even if said expense has already been paid.

Receipts for travel-related expenses must** be submitted, providing:

- a named payee, which is the name of the reimbursement-submitter

- date that confirms payment has been made for a stated purchase

- proof of payment, i.e. last 4 digits of credit card

- *Unless the purchase is a travel-related purchase under $50. Per diem for travel-related purchases are $50 or the IRS rate for that city, no receipt necessary. This is meant for food and small incidentals.

For hotel or AirBnB stays the expense report must include an original hotel folio receipt that details the:

- Rate;

- Date of stay, and;

- Proof of Payment

For airfare the expense report must include:

- A receipt or detailed itinerary that includes all departure/arrival time and location, flight numbers, class of service, fare basis, ticket or confirmation number, and cost of ticket;

- Proof of payment (credit card statement alone is not sufficient);

- Boarding passes should be included when possible

Tolls and parking fees are reimbursable with receipts.

- Specific origination and destination locations (use screenshots in Google Maps or comparable website) should be included for distance and tolls documentation.

- Receipts for parking fees

For all items, see required documentation for travel expense reimbursement reports.

https://rutgers.box.com/s/7dmtb6ignsrxim5pqgpufd3v4beiq7qe

Procedures for Expense Reporting by Item

Commercial Airfare

Travel by chartered or private aircraft is prohibited without prior authorization from the Office of Risk Management and Insurance.

Travelers must purchase commercial standard coach class airline tickets through Concur or Direct Travel. Travel booked using other means will not be considered university business and will not be reimbursed.

Rutgers will reimburse a traveler for reasonable and appropriate baggage fees. Travel insurance is not reimbursable. Flights booked using personal airline Frequent Flyer miles are not reimbursable.

Supporting Documentation:

- Not necessary, airfare is booked and paid for via Concur

If out of policy exceptions are required due to unforeseen or unique circumstances, the Travel Policy Exception Request Form should be completed. This form must be approved prior to booking any air reservation. The approvals will be determined on a case-by-ase basis. The approved form must be attached to the traveler’s expense report.

Travelers should be mindful to keep costs low whenever possible. Tickets should be purchased at least 14-21 days in advance of travel. However, due to the cancelation penalties imposed by airlines, travelers should try to balance the need for savings generated by advance purchase with the knowledge that travel arrangements cannot be changed without significant penalty. Trip insurance is not a reimbursable expense.

When a more favorable price can be obtained for airfare by adding additional days to the trip, reasonable expenses for lodging and meals for the minimum necessary additional days may be reimbursed but the total cost of the reduced fare plus the additional days’ expenses must be lower than the lowest available airfare without the additional days of travel. Proof of the ticket fares must be included with the expense report to show the lower cost.

If a traveler chooses to drive rather than fly to the destination, mileage reimbursement and lodging cannot exceed the lowest cost of a commercial coach airfare. Travelers should include an airfare quote with supporting documentation. Meals or lodging will not be reimbursed while driving to the destination.

Upgrades

Travelers have the option to upgrade to business or first class by paying the difference with personal funds or by obtaining written approval from chancellor level prior to the trip. Upgrade from economy to premium economy requires written approval prior to the trip from the unit head. Proof of the standard coach class ticket cost and the upgraded ticket cost along with the written pre-approval must be included with the expense report to show the cost differences. Trips that extend beyond business purpose must provide a comparable cost estimate of the travel costs at the time of booking for the exact business days to ensure no additional cost is incurred.

Submit to Travel Accommodation Policy Exception Request Form.

Train Fares

Travelers must purchase standard coach class rail tickets through Concur or Direct Travel.Booking using other means will not be considered university business and will not be reimbursed.

Rutgers will reimburse travelers for reasonable and appropriate baggage fees.

Supporting Documentation:

- Not necessary, train tickets are booked and paid for via Concur

Bus Fares

A ticket stub showing the bus fare or a detailed receipt showing the fare must be submitted with the expense report.

If out of policy exceptions are required due to unforeseen or unique circumstances, the Travel Policy Exception Request Form should be completed. This form must be approved prior to booking any upgrades to Acela or a class of service on Amtrak other than coach. The approvals will be determined on a case-by-case basis. The approved form must be attached to the traveler’s expense report.

Lodging Reimbursement

Hotels

It is the university policy to reimburse lodging expenses for business related travel for the Rutgers traveler only. There are no hotel per diem rates. Lodging is reimbursed at 100 percent of the actual expense for a standard hotel room plus tax. You can book hotels through Concur or outside, and submit for reimbursement.

International: For international hotel stays, only a single occupancy rate is reimbursable.

Any additional costs that result from family/companion travel or additional days are the responsibility of the traveler.

For any travel accommodations requested which are outside usual reimbursement procedures (such as adding in a family/companion), submit this form Travel Accommodation Policy Exception Request Form

The expense report must include an original hotel folio receipt that details the:

- Rate;

- Date of stay, and;

- Proof of Payment

Conference-Related Lodging

If travelers are attending a conference or other business-related event, it is advised to stay at the conference designated hotels. If the conference hotel is not chosen, reimbursement will not exceed the conference hotel rate without justification and approval from the unit head. An explanation of the exceptions must be included in the reimbursement request and attached to the expense report.

Airbnb or similar

Travelers are permitted to book with Airbnb/Vrbo/other lodging types, they will just book personally, pay for the Airbnb and submit for reimbursement.

The expense report must include an Airbnb receipt that details the:

- Rate;

- Date of stay, and;

- Proof of Payment

Sharing Rooms

Travelers sharing rooms should pay for the hotel room cost (half the room, if they’re splitting with one other person) with their personal card and submit for reimbursement.

The expense report must include an original hotel folio receipt that details the:

- Rate;

- Date of stay, and;

- Proof of Payment

Car Rental

Reimbursement for car rental is limited up to intermediate size classifications for individual travelers. Larger size vehicles or vans (no larger than 12 passenger) are allowed for groups of three or more travelers. Additional passengers must be listed in the “Description” fields of the expense report.

Reimbursement will normally be made only to the traveler who signed the rental contract; however, reimbursement can be made to individuals that are sharing the cost of the rental car. All authorized drivers must be listed on the car rental contract.

Travelers must purchase rental cars through Concur or Direct Travel. Booking using other means will not be considered university business and will not be reimbursed.

Rental car reservations made through the Rutgers Online Travel Booking Tool or travel agency are paid by the traveler and submitted for reimbursement.

If a traveler chooses to drive rather than fly to the destination, car rental fees plus fuel cannot exceed the lowest cost of a commercial coach airfare. Travelers should include an airfare quote with supporting documentation. Meals or lodging will not be reimbursed while driving to the destination.

Tolls, fuel and parking fees are reimbursable with original receipts.

Individual travelers requiring out of policy exceptions due to unforeseen or unique circumstances are required to complete the Travel Policy Exception Request Form. This form must be approved prior to booking any vehicle larger in size than intermediate. The approvals will be determined on a case-by- case basis. The approved form must be attached to the traveler’s expense report.

Personal Vehicle Travel

Rutgers will reimburse a traveler who uses a personal car for Rutgers business purposes at the current authorized mileage rate. Gasoline for a personal vehicle is not reimbursable; mileage reimbursement rate covers this cost. Gasoline expenses are only reimbursable for rental or university-owned vehicles.

If a traveler chooses to drive rather than fly to the destination, mileage reimbursement cannot exceed the lowest cost of a commercial coach airfare. Travelers should include an airfare quote prior to the trip start date with supporting documentation. Meals or lodging will not be reimbursed while driving to the destination.

Tolls and parking fees are reimbursable with original receipts. The expense report must include:

- Specific origination and destination locations (use Google Maps or comparable website) and

distance; and

- A detailed business purpose;

The current automobile mileage reimbursement rate, listed on the University Procurement Services, Reporting Travel Expenses, is intended to cover all operating costs including depreciation, repairs, gas, insurance, towage, etc. The current auto mileage rate is available in the Travel-Related Expenses Section under Automobile Mileage Rate.

Ground Transportation

Reimbursement may be requested for ground transportation from the traveler’s home, or from their work site to the airport, bus, or train station. Before using either taxi, alternative ride-share or car service, the traveler should determine that it is more economical and reasonable compared to personal car usage, adding in tolls and parking. If a car service will be used, the traveler should contact the University’s Preferred Car Service Suppliers.

Meal Expenses

- Per Diem Meal Expenses

Rutgers reimburses meals when travelers are in active travel status. Travel status is defined as traveling:

- For a period of at least 12 consecutive hours, or

- At least 100 miles from the Rutgers departure point.

When a traveler is not in travel status, meals are considered a personal expense and are not reimbursable.

Travelers have two meal reimbursement options. Travelers must select one option for the entire trip in order to receive reimbursement.

- Rutgers per diem rate of $50 for all cities (domestic or foreign)

- IRS per diem rates (see Related Links) for the city you’re visiting, as described on the University Procurement Services Reporting Travel Expenses

The per diem must be reduced by the percentage below to prorate for provided meal(s) included with a hotel rate or at a meeting or conference:

| Meal | % of meal per diem rate |

|---|---|

| Breakfast | 20% |

| Lunch | 20% |

| Dinner | 60% |

The per diem rate must be prorated for the date of departure and date of return at 75% of the per diem rate minus any meals provided.

When the trip includes more than one location and the cities involved have different per diem rates, the rate for each day (beginning at 12:01 am) is the rate for the location where the traveler obtained lodging that night.

- Business Meals - Over Per Diem Rate

Business meals are meals with a clearly substantiated business purpose and are directly associated with University business. Chancellors and Chief Business Officers can establish caps for business meals while budget owners can impose additional restrictions. An Internal Purchase Order (IPO) is the preferred way of payment for Dining Services while an IPO or PCard is the preferred way for Rutgers Club. Outside establishments can be paid by department PCard or Travel Credit Card.

Business meals should adhere to the following rules:

- Acceptable reasons for business meals include meals with a guest speaker, lecturer or prospective faculty, staff or students. These meals should be limited in terms of number of attendees and the total cost should be reasonable and prudent. If alcohol is included in the meal, the restricted fund source must allow for reimbursement.

- Business meals while not in travel status with other Rutgers colleagues in local restaurants are generally not reimbursable. Local meals with colleagues should be considered a personal expense.

- Business meal expenses include food, beverages, catering services and banquet facilities. Payments to a caterer, facility or transportation of food should be processed using a university purchase order whenever possible.

- Group and other Business meals (not subject to per diem allowance)

- Expenses must be reasonable and prudent

- Special Occasions – retirements, celebrations etc. Prior approval is required in writing from the Dean/Chancellor’s Office

- The most senior RU faculty/Staff member picks up the expense and submits for reimbursement (list of attendees required and an itemized receipt) - list of attendees, valid business purpose and an itemized receipt are required

- If Faculty/Staff is on the receiving end of a meal being paid by another RU traveler (as discussed above), they must forgo the per diem reimbursement and have a note in their expense report stating that “Person X” paid for their meal

- Meals provided by suppliers (potential) – strictly prohibited

- Exception – non-sales event where representatives from Peer institutions are present and no sales or marketing related business is being conducted.

- Example – sponsored networking event at a national conference.

- Alcohol Purchases

Alcohol is permitted (within reasonable limits) provided the appropriate account is used to fund the purchase. It is recommended to obtain a separate receipt for alcohol purchases to facilitate appropriate accounting.

- Meeting attendees must be listed

- Expenses must be reasonable and prudent

- Events with student Participation must be adhere to RU Policy 60.1.11

- Federal or State fund sources cannot be used for alcohol purchases

- Alcohol is allowable on a PCard and travel card as long as above guidelines are followed

Passports and Visas

Fees related to visas are reimbursable when:

- Required by the country the traveler is visiting on Rutgers business-related travel

- Required by the U.S. or foreign country as a result of Rutgers employment or work assignment location

Reimbursements for fees related to passports are allowable when they are a specific and necessary condition of fulfilling a work assignment on behalf of Rutgers University. Travelers should access the visa and passport provider the University is CIBT Visas, using the Rutgers account. Travelers should access the Passport and visa requirements at Travel.State.Gov.

Business Expenses

Requests for reimbursement of other expenses (e.g., the rental of meeting rooms, storage space, or the purchase of special transportation) must be accompanied by a detailed explanation. Prior approval must be obtained from the traveler’s Dean, Director or Department Head whenever possible.

Definitions

Travel Status: When an employee travels more than 100 miles from his or her place of residence or official work site to perform official university business.

Traveler: Any person who incurs travel expenses on official university business and is entitled to reimbursement of those expenses.

Trip: Travel from an individual’s work site for a duration of at least 12 hours for a specific business purpose, such as, attending a conference, providing a paper, or conducting research. An individual can take several consecutive trips while on travel status. Each trip can be reported on a separate expense report or on one expense report with each trip clearly indicated.

Unallowable Expenses: Expenditures that may not be reimbursed, recharged, or paid to a vendor, such as:

- Meal /Entertainment expenses that are lavish or extravagant under the circumstances

- Expenses incurred more than 12 months prior to reimbursement request. Reimbursement exceeding 1 year are deemed taxable and processed through Payroll. Expense Report system will reject requests for reimbursements that were incurred more than 12 months prior.

- Meal /Entertainment expenses for employee birthdays, weddings, anniversaries, or farewell gatherings (excluding celebrations for retirement or for employees separating from University employment with at least 5 years of service)

- Meal Expenses for personal use or for a non-business reason

- Meal/ Expenditures that are not permitted under the terms governing restricted funds

Work Site: This is the official university payroll location to which the employee reports every day.

GSA: the U.S. General Services Administration establishes a per diem rate yearly. The GSA per diem rates are the allowance for meals and incidentals. Rutgers University allows incidentals to be reimbursed at actuals. Items that fall under Incidentals are tips for porters, baggage carriers or hotel staff.

Legitimate Travel-Related Incidentals: Small dollar purchases that occur and are required for successful completion of the business trip. Examples of appropriate travel-related incidentals are: books, office and teaching supplies.

Necessary: This means that the expenditure is required to achieve the expected goals or outcomes of the program, project or task.

Per Diem: a daily payment instead of actual expenses for meals while travelling on University Business

- Expenses for breakfast, lunch, snacks, dinner and related tips and taxes are included in per diem.

- Per Diem is reduced on travel days to 75% of the per diem regardless of trip departure time.

- Per Diem is prorated for meals provided based on 20% breakfast, 20% lunch and 60% dinner.

The current per-diem chart is located the procurement website under ”Related Links”: https://procurementservices.rutgers.edu/travel-and-expense/reporting-travel-expenses

Proof of Payment: Documentation (e.g., receipt, credit card charge slip, hotel folio) that indicates that the individual has settled the bill in full with the service provider.

Prudent: Wise in practical matters, careful for one’s own interests.

Reasonable: The cost of the good or service is not excessive.

Receipt: An original document itemizing the good(s) or service(s) purchased. The receipt must provide a named payee and date that confirms payment has been made for a stated purchase. Method of payment must be shown on the receipt. If the receipt is lost, the individual seeking reimbursement must complete the Lost Receipt Certificate Form. This form is available in the Travel and Expense Section of the Forms Repository.

Standard Operational Procedure (SOP): A set of instructions that functionally describes the key procedures.

Travel Advance: When a traveler requests university funds in advance to pay for upcoming travel-related expenses. Also known as a Cash Advance. This must be initiated in Oracle Expense.

Travel Order: A form that must be completed and approved any time the direct billing option is used to purchase air or rail tickets through the university’s preferred travel agencies.